WZWH cuba menjelaskan dengan mudah apa yang pembangkang sengaja pusing fakta mempengaruhi rakyat menolak kerajaan BN pada PRU 14 guna isu hutang kerajaan Malaysia.

Ini posting hutang kerajaan Malaysia dan GDP (Gross Domestic Product) @ KDNK .

Malaysia Government Debt To GDP

Malaysia recorded a Government Debt to GDP of 54 percent of the country's Gross Domestic Product in 2015. Government Debt to GDP in Malaysia averaged 48.22 percent from 1990 until 2015, reaching an all time high of 80.74 percent in 1990 and a record low of 31.80 percent in 1997. Government Debt to GDP in Malaysia is reported by the Ministry of Finance, Malaysia.

This page includes a chart with historical data for Malaysia Government Debt To GDP.

Ahli ekonomi dunia kata hutang kerajaan jika peratusannya kepada GDP dibawah 55% hingga 60% adalah masih boleh diurus.

Malaysia mempunyai rekod membayar hutang negara yang sangat baik tidak pernah default. Kalau kita lihat Malaysia pernah mencatat peratus hutang yang tertinggi pada Disember 1990 iaitu 79.5%

Adakah pada masa itu Kerajaan Malaysia bangkrap?

Pembangkang banyak main isu hutang kerajaan Malaysia seolah-oleh pentadbiran DS Najib sebagai PM gagal mengawal ekonomi yang dipsywar boleh menjurus kepada negara bangkrap.

Apa yang DS Najib sedang buat bagi mengurus dan menurun peratus hutang kerajaan Malaysia seperti berikut:

- Malaysia's debt is still manageable as it is below 55 per cent to the Gross Domestic Product (GDP) ratio

- 53.8 per cent of national debt for last year is within the range as the government continues its efforts to bring down the fiscal deficit level.

- With the implementation of the Economic Transformation Programme, we are on the right trajectory and continue to reduce the deficit level every year. For 2012, we aim to narrow further the fiscal deficit to 4.7 per cent from 5.0 per cent of last year's GDP.

- We borrow for investments (aiming) to grow our GDP and economy. The debt level will directly reduce. Unlike Greece, they are borrowing a lot of money but the economy is shrinking.

Bagi pembaca yang 'well verse' dengan economics sila baca soal jawab hutang kerajaan Malaysia sila klik sini.

Kerajaan Malaysia berhutang kerana membiayai pelaburan yang boleh menjanakan lebih banyak pendapatan dimasa hadapan disamping menyediakan barangan dan perkhidmatan dan memberi pekerjaan bagi pertumbuhan ekonomi negara.

Kerajaan Malaysia berhutang kerana membiayai pelaburan yang boleh menjanakan lebih banyak pendapatan dimasa hadapan disamping menyediakan barangan dan perkhidmatan dan memberi pekerjaan bagi pertumbuhan ekonomi negara.

Hutang Kerajaan: Perbandingan Masa Tengku Razaleigh dan Najib Jadi Menteri Kewangan

Mari kita buat perbandingan masa Tengku Razaleigh dan Najib jadi Menteri Kewangan.

Mari kita lihat kembali pada metrik fiskal semasa Ku Li sebagai Menteri Kewangan (defisit fiskal dan hutang kerajaan sebagai nisbah kepada KDNK; kawasan berlorek):

![[01_deficit%255B2%255D.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgiQuL3UN2jSR5PuI1B6KfTquhhaoaMlsnTodxk9xUPitg9ZVNuCABdafhtfY_-NbxHBjhE2gOCvV6TaPoyOIz70ZPJLvQ4RUrITozjqzk5s1EfOhAZ8bpxUfW3TWUKwdynqHvP_qRfgCo/s640/01_deficit%25255B2%25255D.png)

![[02_debt%255B2%255D.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiKLQ0FxrKkL_zFFLBg4aiKAaq_iN3AGkfdl-I1Fu9LJW8iWJPl73rwQBSV7niexydmi10jQqB5kuZrd6aWgwpqf9uRS7lAXsHfNpx0cLXmug2ca8kwEBfVv7ZfW3OsWhbrlp9bqF3mx6M/s640/02_debt%25255B2%25255D.png)

Sumber: Blog Economics Malaysia

Yang benar adalah, pengurusan fiskal adalah dan boleh menjadi acara tertentu. Ku Li terpaksa berhadapan dengan kejatuhan terbesar dan paling ketara dalam harga komoditi global dalam sejarah moden.

Kerajaan sekarang ini pula terpaksa berhadapan dengan kemelesetan global yang paling lama dan paling teruk sejak Kemelesetan Besar The Great Depression.

Masa Najib menjadi Menteri Kewangan cabarannya adalah lebih getir dan lebih mencabar. Kita rakyat Malaysia perlu mendokong penuh usaha-usaha dan program-program Najib sebagai Menteri Kewangan dan Perdana Menteri bagi menghadapi cabaran ini semua demi kepentingan rakyat dan negara.

Semasa Mahathir menghadapi krisis kewangan Asia 1997 ketika itu Mahathir juga adalah Menteri Kewangan dan Perdana Menteri.

DS Najib sebagai Menteri Kewangan dan Perdana Menteri sekarang ini berkeyakinan tinggi untuk mengurus ekonomi semasa era kemelesetan global yang paling lama yang Malaysia sedang hadapi sekarang.

Selain itu, tidak masalah besar. Tidak ada yang "tiga kali ganda" hutang luar negeri Malaysia antara 2014 dan 2013. Jika anda mengambil takrif baru ke belakang, peningkatan dalam 4Q14 lebih 4Q13 adalah lebih sederhana 8%, atau lebih kurang sejajar dengan pertumbuhan KDNK nominal Malaysia. Dalam erti kata lain, tiada apa yang benar-benar berlaku.

A FAQ On Malaysian Government Debt

There’s a lot of misconceptions and misunderstandings regarding the level and sustainability of government debt, which has been seriously skewing the public discourse not just about Europe and the US but here as well. [For examples, here, here, here, here and here].

Rather than arguing the points one by one, I’m putting up this FAQ as a central reference point, with some faint hopes that we might move on to a better informed debate about the issue. It’ll be available as a permanent page (see the menu on the top right of every page on this blog), and I’ll update it from time to time. The focus will be on the Malaysian situation, but some of the general principles are applicable elsewhere as well.

First the raw data (RM millions; sample period 1970-2012, with 2011-2012 data based on estimates):

Up to 2Q 2011, government debt in total has reached RM437 billion, or approximately 53% of nominal GDP:

Based on Budget 2012 numbers, total government debt outstanding should reach just over RM495 billion by the end of 2012.

The average rate of increase for the last 40 odd years has been about 11% in log terms (log annual changes):

And on a per capita basis (RM):

Based on 2012 numbers, the per capita debt should reach a little over RM 17,000 per person by the end of that year.

Finally, the fiscal deficit (ratio to nominal GDP):

You’ll see from the above that it’s not unusual for Malaysia to run a fiscal deficit – in fact it’s been the norm, except for a short period in the mid-1990s.

Now on to the FAQ:

Q1. Government debt is like household debt – if we spend more than we earn, we’ll go bankrupt

A. That’s the common sense view, and its one that’s commonly held. The problem is that it’s also mostly wrong.

Here’s where the misconception lies – if you’re a household, you earn income based on your work and investments. For a company, income depends on selling the goods and services it produces. For both parties, that income represents the upper limit of what can be paid to service debt. It’s also – and this is the important point – determined by conditions mostly outside your control. You have to depend on someone else to determine your wages; the prevailing interest rate or investment rate governs returns; and market supply and demand (most of the time) limits what a company can sell.

But that’s not true of government generally. It’s “income” comes largely from direct and indirect taxation – the rates of which are determined by the government itself. So in a very real sense, governments don’t face the hard constraints that households and companies do. Instead its a soft constraint of what level of taxation citizens are willing to bear.

But even if governments come up against such a limit, there’s also the little fact that most governments also have a de facto monopoly on the issuance of money. As long as a government’s debt is denominated in its own currency and it retains control over issuance of that currency, government debt can always be paid off.

Third and more importantly, if government spending is directed towards investment which raises the productive capacity of the economy e.g. spending on education, that effectively raises the futuretax yield, which indirectly allows a higher burden of present debt.

In the end, the real limit to government borrowing (and spending) is neither taxation nor the printing press – its the ability of an economy to produce goods and services. Which leads to the next point.

Q2. Bigger and bigger amounts of government debt is inflationary

A. It depends – and the size of debt isn’t the factor here, it’s what the money raised from debt issuance is spent on.

Consider a closed economy (i.e. no external trade) with three separate sectors – households, companies and the government. All three sectors produce and consume goods and services. Inflation occurs when demand for goods and services from all three sectors exceeds production. The only way for government spending to be inflationary is when it causes total spending from all three sectors to exceed that limit.

Now consider a case where households and companies suddenly want to spend more while the government maintains its level of spending. We’ll now have a case of excess demand and inflationary pressures even though the government is not spending any more than it did before.

Suppose the opposite case where households and companies suddenly want to save more instead. Under those circumstances, an increase in government spending up to the limit of the productive capacity of the economy will not be inflationary since its only taking up the excess supply that households and companies don’t want.

But inflation actually represents another way for governments to reduce their debt burdens and is often termed “implicit taxation” – if governments spend to the point where inflation increases, that effectively reduces the real burden of debt, and not just for the government but for all debtors. That’s because debt is contractually determined at the point of borrowing (in the past), but payment is usually in current tax dollars (which with inflation has lower purchasing power). Inflation also raises nominal growth, which generally means more tax dollars for a given level of real output.

Historically, with the exception of actual defaults, government debt has often been paid off through two channels – inflation and economic growth.

Q3. The Malaysian government has been running a deficit for years – but it should only be running a deficit in bad times. In good times, it ought to be saving and paying down debt

A. There’s another implication from the discussion on Q2 – whenever there’s an imbalance in the savings/investment decisions of households and companies, the opposite situation must prevail in government spending and investment for an economy to be maintained at full output and income generation .

If households and companies are saving more, the government has to dissave. Otherwise, demand will be deficient, and household and company surplus falls, which makes their saving pointless. If on the other hand households and companies are overspending, then the government has to save. Otherwise you’ll get inflation.

So it’s not just a binary decision of good times (save)/bad times (spend) for government expenditure, which is the popular notion of Keynesian economics. It’s more than possible to have a situation of economic growth but with excess saving in the household and corporate sectors. Excess government spending then helps maintain that growth situation with full employment, but with the side effect that it requires government spending to exceed its revenue.

Let’s take it one step further by adding an external sector (i.e. trade) to our though experiment.

In aggregate, if a country is running a trade surplus, then production in the economy exceeds consumption – in short, the economy as a whole has excess savings. The opposite is also true, in that a trade deficit indicates an economy that is consuming more than it produces. So far so good.

Plug in the conclusions from the preceding discussion and you get the following – excess government spending is not a big problem with a trade surplus, but a government should cut back its spending with a trade deficit. In the former case, whether the government should run a deficit or not depends on whether external demand is sufficient to provide full domestic employment. In the case of a trade deficit however, the advice is unequivocal – you have to run a budget surplus unless you’re willing to tolerate higher inflation.

Hence the consistent concern over America’s “twin” deficits over the past decade.

Q4. All this increase in debt will be a burden on our children and our children’s children

A. This is based on the idea that debt has to be repaid eventually, and the main source of government income is taxation – basically a corollary of the idea that a government is similar to a household. Hence, in this view, the greater the debt build-up the greater the expected future level of taxation. The popular notion is thus that of the current generation borrowing from future generations.

There’s a problem with this conception. First, since governments are collective enterprises on behalf of the governed, there’s no natural lifespan involved. There’s no necessity for debt to be fully paid off and it can be effectively carried in perpetuity. Some governments have actually taken advantage of this fact to issue perpetual bonds that never mature, and at least one major government has issued a 999 year bond.

But the most important point is this – whether government debt accumulation will become a burden on future generations depends greatly on who the debt is owed to. If the debt is held by citizens or agencies acting on the citizens behalf (for example EPF), then the taxes raised to pay for maturing debt comes from citizens and the debt payment goes back to citizens. All that occurs is a change in financial obligations and possibly some redistribution of wealth, but not a net burden on taxpayers.

That’s how Japan has managed to raise public debt to over 200% of GDP, yet is barely penalised by bond investors – most of that debt is held by domestic institutions like postal savings banks and pension funds. The Japanese are in effect lending to their government so that the government can spend it on them.

In Malaysia’s case, the ratio of foreign holdings of federal government debt has been rising steadily since 2005, but its still at a fairly low level (Government debt, not including BNM bills):

For the rest, about a quarter is held by social security institutions like EPF and SOCSO, the financial sector (banks, insurance companies) hold another quarter. Holders of general investment issues aren’t specifically classified, but foreign holdings of GII are relatively minor according to RENTAS.

Q5. Government debt growth is being aided and abetted by our pension and investment funds, which are now at risk

A. Here’s an interesting question for you – which is the better credit risk, a household or company who faces hard budget constraints on income and expenditure, or a government with discretionary powers of taxation and a printing press?

Government debt typically forms the benchmark for all bond issues in an economy. Even the best rated companies pay more on their debt than the government of their country. It goes back to the safety factor. That’s why pension funds and insurance companies put most of their investible funds into government securities. Whatever the risk of investing in government securities, every alternative except cash is riskier.

Q6. Since most of government debt is owned by Malaysians and only some by foreigners, the foreigners will get paid first while we have to pick up the bill

A. Actually, the reason why there’s such elaborate care and concern over foreign bond investor perceptions and rights – not just here but globally – is because historically when countries do default, it’s almost always a default on external debt, not on the debt held by domestic institutions.

It’s not hard to figure out why – when we’re talking about citizens, no democratically elected government would dare default on its debt obligations as it risks being booted out otherwise. Same thing for institutions such as pension funds and insurance funds, which take care of the future financial needs of their investors (read: voters). For banks, a domestic default could mean the government needing to bail them out, which makes a default worthless.

So foreigners are always first in the firing line, which makes them understandably skittish.

Q7. The government went on a spending spree during the recession

A. In 2008, in response to the Lehman Brothers collapse and the resulting shutdown of the international financial system, Malaysia instituted a fiscal stimulus package worth RM7 billion. When that didn’t appear to be enough, a bigger spending package with a face value of RM60 billion was passed through Parliament in March 2009, which put the total up to RM67 billion. That sounds like a lot, especially since both were enacted under conditions where tax revenue was expected to drop.

But here’s what really happened: Of that RM67 billion, RM5 billion was for National Savings Bonds paying 5% interest intended to help retirees and pensioners to raise their income even as BNM cut banking interest rates (i.e. it was actually revenue, not expenditure); RM7 billion was in Private Finance Initiatives, where the government didn’t pay a sen; RM20 billion was in credit guarantees for SMEs and small businesses, where again the government didn’t pay a sen; and only the remainder of RM35 billion was allocated for direct spending. That’s still a lot, and helps explain why debt ballooned in 2009/2010.

Or does it?

The truth is, Government expenditure in 2009 was only about RM1.4 billion higher than the original 2009 budget proposals sent to Parliament in 2008:

By my estimates, about RM14 billion of both stimulus packages were actually spent in 2009, yet the increase in total government spending was only a tenth of that. The implication is that most of the funding for the extra spending didn’t come from extra borrowing, but from cuts in other government programs. From my point of view that’s no spending spree, that’s being overly tight fisted – 90% of the stimulus effect was swallowed up by cutbacks in other areas..

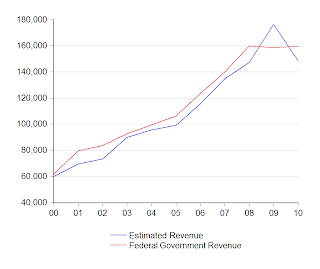

So how come government debt rose sharply in 2009? Because government revenue came in at 10% below the budget estimates - in fact a little worse than the contraction in 2009 GDP of 9.9%:

Q8. We’re in trouble because debt has doubled in the past five years while income hasn’t

A. This is almost true: at the end of 2005, Federal Government debt stood at about RM229 billion and rose to RM407 billion by 2010. Nominal GDP on the other hand only rose from RM522 billion in 2005 to an estimated RM766 billion in 2010. But this little calculation is also wholly misleading as an indicator of debt sustainability.

The key point is that the recession seriously dented not just government income but the nation’s nominal income as a whole – the recovery in 2010 saw national income only just passing the level reached in 2008. In the meantime, the government had to deal with the drop in revenue in 2009, and thus had to borrow to cover the difference.

Looking at the growth rates, debt growth actually lagged income growth from 2005-2007:

It was only the recession that caused debt growth to jump, and it has now come down to more sustainable levels. As long as debt growth falls more or less in line with income growth, we should be fine.

Looking at the experience of the last recession (2000-2001) will give you an idea of why just taking a five year comparison won’t give you an accurate picture of the real situation.

Q9. Government debt isn’t sustainable because operational spending is greater than revenue

A. I think this came from a misunderstanding of what was said by Idris Jala at the recent ETP anniversary event. But it’s pretty easy to disprove:

The government’s operational balance has been negative in just three years out of the last 40, and it has not been in deficit since 1987. As required by law, the government only borrows to finance development expenditure, i.e. investment that will raise future capacity to produce.

Q10. Government debt is nearing the legal debt limit, and they won’t be able to borrow anymore so we’ll have to default

A. satD has covered this question in detail, so I won’t post more than a summary – the legal limit is a paper tiger and the government can change it anytime it wants. If at any point the government fails to gain legislative approval to raise the limit, in our system of parliamentary democracy that means an immediate dissolution of parliament and fresh general elections.

You’re not going to see a repeat of what happened in the US in August here. The US uses a presidential system, where the executive is elected separately from the legislative. Since this system is designed to promote checks and balances, that almost always means that a Democratic President has to deal with a Republican Congress and vice versa. The result is typically political gridlock.

Q11. The Treasury says the national debt is RM240 billion but the outstanding government debt is RM437, someone must be lying

A. It’s a funny thing but in Malaysia, we don’t use the term “national debt” in the way it’s commonly used elsewhere. Here the term refers exclusively to external debt only, of both the public and private sectors, and not to government debt.

So in Malaysia, government debt and national debt mean two very different things. The government’s external debt, by the way, is all of RM17 billion.

Q12. In ten years time, we’ll be like Greece

A. Greece has a 2000 year history of defaulting on its external debt. Malaysia has never defaulted on its debt.

Greece has had a debt to income ratio over 100% for the last twenty years, a ratio that is expected to climb to over 150% this year. Malaysia’s debt to GDP ratio peaked at 70% 25 years ago, and is at most 54% today.

Greece has something like three quarters of its debt owing to foreigners. Malaysia only owes about one fifth of its government debt to foreigners.

Greece is part of the Eurozone, and thus has no control over the issuance of its own money. Malaysia through Bank Negara controls the supply of Ringgit.

Worse, the European Central Bank is legally bared from becoming a lender of last resort for the Eurozone governments. Bank Negara has no such restrictions.

Greece is uncompetitive – it costs 40% more for a Greek worker to produce a unit of output compared to a German one. (Unfortunately the relevant statistics aren’t available for Malaysia).

Malaysia is not Greece, and we’re not exactly in danger of becoming one in the next ten years.

[If there are any other questions that I haven’t thought of here, feel free to post in the comments and I’ll add it to the FAQ).

Technical Notes:

Data on Federal Government borrowing and expenditure from Bank Negara’s Monthly Statistical Bulletin and from the Economic Planning Unit. Population estimates from EPU and the Department of Statistics

1 comment:

Jordan Travis Scott

palm angels hoodie

supreme hoodie

golden goose outlet store

off white

Post a Comment