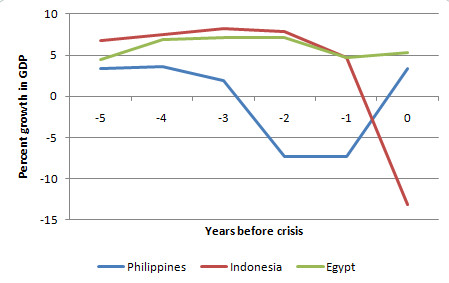

A quick thought about the Egyptian uprising. Many people have sought parallels either in the Philippines 1986 or in Indonesia 1998. But there is a possibly important or revealing difference. As the chart above shows, both of those political crises followed on drastic economic crises — Marcos was caught up in the Latin American debt crisis of the 1980s (in some important ways the Philippines was in effect a Latin American economy at the time), Suharto in the Asian financial crisis. Nothing comparable for Egypt now.

Which is not to say that economics had nothing to do with it. Egypt had decent growth — but the gains weren’t trickling down, and youth unemployment was and is a huge problem.

The moral is that GDP isn’t the whole story. Yes, sensible people already knew that, but this is a graphic reminder.

The toppling of dictator Ben Ali in Tunisia in the wake of mass protests and bloody street clashes has been widely recognized as signifying a major transformation in the future of politics and geopolitics for the major countries of the Middle East and North Africa (MENA). There is little doubt that the Tunisian experience triggered the escalation of unprecedented protests in Egypt against the Mubarak regime. The question on every media pundit’s lips is, ‘Will events in Tunisia and Egypt have a domino effect throughout the Arab world?’

The potential fall of Hosni Mubarak is serious stuff. As The Economist points out, Egypt is “the most populous country in the Arab world”, viewed by the U.S., Britain and West as “a strategic pivot” and a “a vital ally” in the ‘War on Terror’. No wonder then that activists across the world are holding their breath in anticipation that one of the world’s most notorious dictators, and one of the West’s most favoured client-regimes, might be overthrown.

What is happening in Tunisia and Egypt, however, is only a manifestation of a deeper convergence of fundamental structural crises which are truly global in scale. The eruption of social and political unrest has followed the impact of deepening economic turbulence across the region, due to the inflationary impact of rocketing fuel and food prices. As of mid-January, even before Ben Ali had fled Tunis, riots were breaking out in Algeria, Morocco, Yemen and Jordan – the key grievances? Rampant unemployment, unaffordable food and consumer goods, endemic poverty, lack of basic services, and political repression.

We have all been reading about Egypt in the newspapers, and wonder what is behind their problems. Let me offer a few insights.

At least part of Egypt’s problem is the fact that in the past the government has threatened to reduce food subsidies. Now it is planning to hold food subsidies level and raise energy subsidies , but it is not clear that the dollar amount of subsidy will be enough. The government is taking steps to make food and energy affordable for most, but there is worry that the steps being taken will not be enough.

Egypt’s Declining Financial Situation

There is a good reason why one might expect Egypt to start running into problems with energy and food subsidies. Its own financial situation is declining at the same time that the cost of food imports is soaring.

Starting about 2010 or 2011, Egypt will change from an oil exporting nation to an oil importing nation, if there are imports available on the world market. The catch is that Egypt isn’t the only one with declining oil production–world oil production has been approximately flat since 2005, and the countries that produce the oil are using more and more of it themselves. The result is that there is less oil available for export, even as countries like Egypt need more.

The oil that Egypt exports provides funds for the subsidies that it offers, so reduced exports mean less funds are available for subsidies. Egypt has recently been able to ramp up natural gas exports, and these exports have allowed subsidies to remain in place.

Other Budget Pressures

Based on information from the CIA World Fact Book, Egypt was already significantly overspending its revenue in 2009 (the last year available), with revenues of $46.82 billion and expenditures of $64.19 billion. For 2010, the Factbook reports government debt amounting to 80.5% of GDP, putting its debt level far above that of most other African and Arab nations.

If Egypt’s oil production is down, follow-on industries like refining and chemical products are likely down as well, making it difficult to increase revenues from these sources, or to obtain additional taxes related to the spending of workers in these industries. The Suez Canal is one of Egypt’s sources of revenues, but with world oil exports down, revenues from it are likely dropping as well.

Cutbacks in oil production and in Suez Canal transport can be expected to exacerbate unemployment problems. The Egyptian unemployment rate was listed at 9.7% in 2010 by the CIA World Factbook.

Egypt has a history of a fairly egalitarian approach to distribution of income. In 2001, the CIA Factbook lists its GINI coefficient as 34.4%, which is near that of the United Kingdom, and much better than, say, that of the US. But in recent years, the CIA Factbook says Cairo from 2004 to 2008 aggressively pursued economic reforms to attract foreign investment and facilitate GDP growth.

These economic reforms likely raised the income of some people, but not of everyone, creating a wider gap between the rich and poor. This may lie behind reports of concerns by the poor that they are falling farther behind economically. With the county’s history of a more even income distribution and the recent rise in food prices, this rising income inequality may be becoming more of an issue.

Need for Food Imports

Egypt is reported to be the world’s largest importer of wheat. In 2010, Egypt imports 40% of its food, and 60% of its wheat. The problem this year is that world wheat production is down (at least in part due to weather problems in Russia) so world exports are down.

The higher food prices contribute to the overall inflation problem that Egypt already had. In 2010, the CIA Factbook estimated the inflation rate to be 12.8%. Since wages don’t always rise to match inflation rates, inflationary pressures have no doubt put more pressure on the government to increase subsidies, at a time it cannot really afford to do so.

Impact on the Rest of the World

Why does everyone else respond so strongly to Egypt’s problems?

One reason is that other Arab countries are also feeling some of the same pressures. Food prices are rising everywhere. Many low income people spend in excess of 50% of their income for food, so a rise in food costs becomes a real issue. People have come to depend on oil and food subsidies. If they are taken away, or not raised sufficiently to compensate for the higher costs of imports, it is a real problem.

Oil prices seem to be affected as well. If the Suez Canal should be closed because of disruptions, it could affect oil transit, particularly to Europe.

Lessons to Malaysia

Although Malaysia is currently experiencing 6% GDP thus trying to make economic reforms by reducing subsidies, higher income economies, introducing many EPPs and other measures there will be time when Malaysia will change from an oil exporting nation to an oil importing nation, problems will arise.

3 comments:

Sound analysis indeed but skewed towards economic spectrum.

1. Yes, Malaysia records a 6% economic growth. Sensibly we should be happy in view of the world-wide economic crisis. However, does this growth being felt by the Malaysian majority or it is just being circulated within the confine of few? Despite the growth, the economic divide is getting wider and it is going to be wider and wider.

2. Two nights ago, I was watching TV about the happenings in Egypt. A network correspondent asked his guest on the root cause(s) of this uprising. The guest said "Tunisia, Egypt and Jordan share ONE common denominator; powerful and ambitious bedfellows of the frontal Presidents or King". The interview then abruptly went into blank mode. Can any watchful eyes share whether this observation is budding up in our beloved Malaysia?

Salam,

Mohon link ke blog Tuan.

http://laksabentan.blogspot.com

Salam LB,

WZWH sudah link blog Laksamana Bentan, TK.

Post a Comment